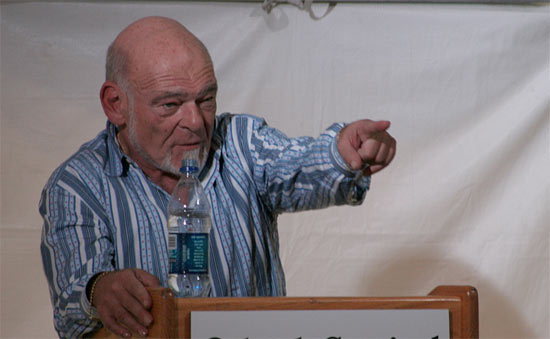

Both the Wall Street Journal and New York Times are reporting tonight that the Tribune company has hired an investment bank and a law firm for a potential bankruptcy filing as early as this week. This is definitely a long way down the road from a year ago when the arrival of Sam Zell was seen as a bold move toward the reinvention of a once-great newspaper brand.

Now?

Here’s the New York Times take:

Tribune has hired bankruptcy advisers as the ailing newspaper company seeks to stave off a potential bankruptcy filing, people briefed on the matter said.

The newspaper, which was taken private last year by billionaire investor Samuel Zell, has hired the investment bank Lazard and the law firm Sidley Austin, these people said. Tribune has been hobbled by debt related to that sale last year, which has been compounded by the growing drought of advertising for newspapers.

The Wall Street Journal puts the Tribune distress in perspective:

The appointments underscore the deepening distress for Tribune and other publishers. Newspaper businesses are being battered by dwindling advertising sales and carrying debt loads that are unmanageable in current market conditions. People in the industry expect some papers will need to seek bankruptcy protection or fold in coming months.

Tribune has been on wobbly footing since last December, when real-estate mogul Sam Zell led a debt-backed deal to take the company private. Tribune so far has stayed ahead of its $12 billion in borrowings with the help of asset sales, but now dwindling profits are tightening the noose. The company’s cash flow may not be enough to cover nearly $1 billion in interest payments this year, and Tribune owes a $512 million debt payment in June.

Based on the state of declining revenues at the company and its lenders’ likely unwillingness to allow Tribune to simply sell off assets to make its payments (as it did with the sale of Newsday in 2008), bankruptcy looks increasingly inevitable. These actions seem to imply that the question may be called sooner than the mid-2009 period I had seen mentioned previously.

ragi64 says

ragi64 says

January 8, 2009 at 9:31 amThis blog is awesome!